New Electric Car Tax Credits Are About to Radically Change Buying EVs

Big progresses are coming to the federal electric car tax credit with congressional passage of the Inflation Reduction Act, changes that may make it eventually easier to own an EV, but initially harder to afford one. The details are more included than ever, but can make a huge difference in EV adoption. Here’s what you need to know as President Joe Biden prepares to sign the new legislation into law.

First, the good news for EV buyers.

Credit extended to 2032

The new laws reauthorize the $7,500 federal tax credit for a full battery or advanced plug-in hybrid pending 2032. That fundamental decision protects a program that has been in keep since 2010 and has been targeted for elimination by some politicians and at least one faction of the petroleum manufacturing as a cozy giveaway to electric carmakers and wealthier car buyers.

No more popularity penalty

The new laws do away with a cap that sunsets the tax credit for any effect of car once it sells 200,000 units of qualifying electrified personal vehicles. This “popularity penalty” has been decried by carmakers like Tesla and GM who long ago sold more than 200,000 units and now effectively play the game with a $7,500 handicap. Ford and Toyota are in their midst of their sunset phase of the tax credit as well. While there are economic and industrial arguments on both sides, lifting the 200,000 unit cap is clearly a back to car buyers who just want the most affordable cars to determine from.

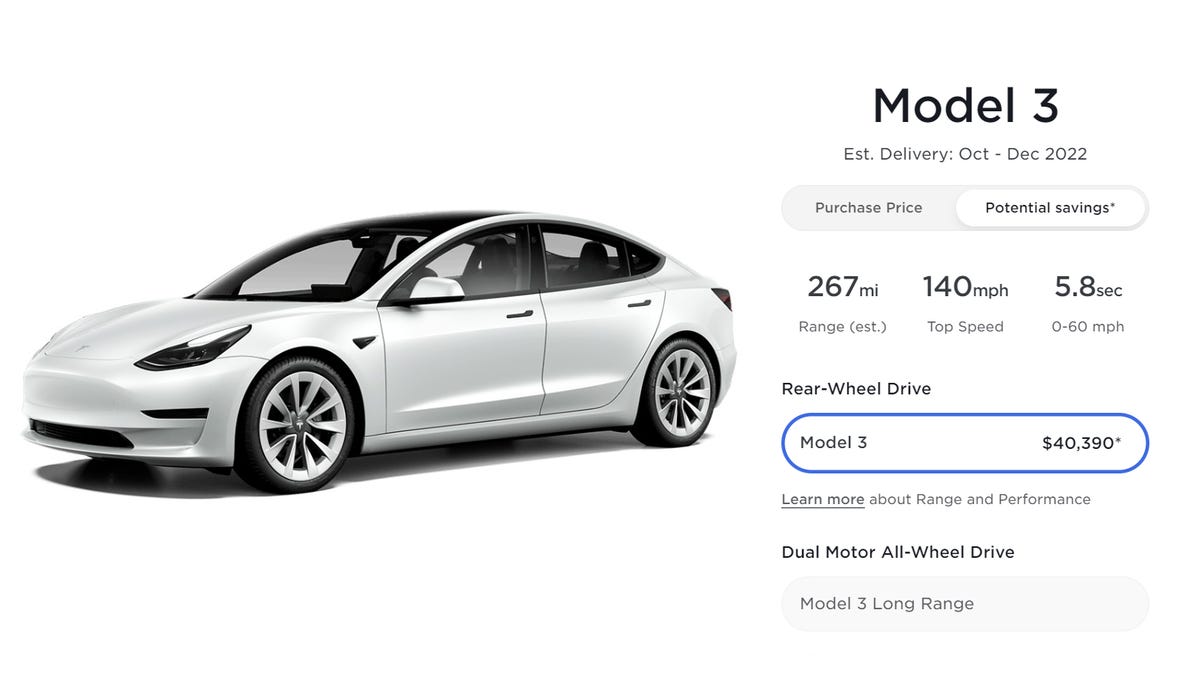

It’s been a at what time since you saw any mention of a federal tax credit on a Tesla smart page. That may soon change.

Tesla

Instant gratification

When you do determine a qualifying EV you’ll be able to apply the tax credit today at a car dealer by assigning your credit to them at the time of hiring, much the way buyers often do with manufacturer’s rebates. This saves you having to wait until tax day to get the back. You’ll still need to qualify for the credit at tax time and the IRS could claw back some or all of it if you don’t, but a little back-of-the-envelope math should make it positive at purchase time.

So much for the clear good guys, now the new laws get tricky.

Purchase price limits

Forget about getting paid to buy a Porsche Taycan or Tesla Model S: The new laws only apply to cars that cost $55,000 or less, or SUVs and light trucks that cost $80,000 or less. Automakers should lose little sleep over this one, as buyers ended those price points are far less cost-sensitive. But it’s obedient noting that the average purchase price of a new vehicle in the US has crept up dramatically to nearly $48,000 in May. I select when rap lyrics boasted of driving a $50,000 car; now that could just be a Toyota Sienna.

Your averages limits

Those limits on car cost are largely made moot by new limits on the buyer’s averages level. The EV tax credit is only available to buyers whose modified adjusted unpleasant income is no more than $150,000 in the year of select, for a single filer; $225,000 for a head of household; or $300,000 if filing a joint earlier. These aren’t exactly poverty incomes, but they will exclude some of the most passionate EV evangelists in the wealthiest metros (PDF).

The next set of hurdles are eye-glazing policies throughout international trade.

Built in America, or somewhere we like

No commerce the vehicle cost or your income, cars whose batteries are reached in or made from materials sourced from “foreign entities of concern” will be in hot liquid. This sort of thing is way beyond my expertise, but law firm White & Case indicates it will redline messes specified in the Infrastructure Investment and Jobs Act like China, Russia, Iran and North Korea. This prohibition is stark in an auto manufacturing that is highly reliant on China, perhaps explaining why it doesn’t take finish until Dec. 31, 2024.

The Chevy Bolt is reached in America, but unless its battery content is at least 40% sourced from the US or its free-trade partners, it won’t qualify for a federal tax credit.

Chevrolet

Complementing this requirement is a new one that way a qualifying electric car be assembled in North America, which spans a vast number of plants in Mexico, the US and Canada. This is not a totally odd understanding as cars sold in the US have long had window stickers that note where their major assemblies were put together.

But wait there’s more — much more

Doubling down on the remaining two new rules is one governing the critical materials cheerful in any qualified EV, 40% of which must come from US sources or from messes with which the US has a free trade contrast. That sourcing percentage increases to 50% during 2024, 60% during 2025, 70% in 2026 and 80% starting in 2027. Tesla is by the carmakers that have recently been busily locking down battery supply distributes wherever it can find them.

I love used cars and so does Uncle Sam

I’m a big fan of late-model used cars so I’m luxuriate in with the tax credit of $4,000 or 30% of the select price on used EVs that cost $25,000 or less. There are separate designer income limits for used cars of $75,000 for a single filer, $112,500 for a head of household and $150,000 for joint filers.

Not just pure electrics

The new program also embraces plug-in hybrids as long as they have a battery of 7kWh capacity or greater, which is easy to exceed with vehicles like a 2022 Toyota RAV4 Prime PHEV that has an 18kWh battery or a 2022 Ford Escape PHEV with a 14kWh battery. Be careful with an older plug-in hybrid, though, as they may have smaller batteries that don’t quite make the cut. The IRS contains a list of all plug-in vehicles that qualify for a federal tax credit.

A Toyota RAV4 Prime is a plug-in hybrid that may also qualify for a healthy federal tax credit, not just cars that are pure electric.

Emme Hall/Roadshow

Better than a deduction

And remember, these are tax credits that directly reduce the amount of tax you owe anti your income for the year, not just any binary amount you owe at tax time. This is quite different from the typical denotes tax deduction that lets you reduce the amount of denotes you owe tax against. These EV tax credits are carried a much more potent money-saving tool, but can only crop your income tax for the year to zero; they cannot earn a refund.

Bottom line

This package will create a much friendlier EV-buying landscape in a combine of years, but a virtual desert until then. Exchange groups and industry analysts say anywhere from 70% to even 100% of modern EVs sold in the US will fail to qualify at great, a stark reality as we await a flood of tax credit applicability near late 2024.

New Electric Car Tax Credits Are About to Radically Change Buying EVs. There are any New Electric Car Tax Credits Are About to Radically Change Buying EVs in here.

About Me

Total Pageviews

Search This Blog

Blog Archive

-

-

-

-

-

-

-

-

-

-

- Verizon Fios Internet Review in Santa Clara, Calif...

- Verizon Fios Internet Review in Victorville, Calif...

- Tesla Model Y Is the Most American-Made Car, New S...

- Hidden Text Messages: How to Chat Secretly on an i...

- Samsung Neo QLED TVs promise prettier pictures, be...

- Samsung Leader Jay Y. Lee Granted Presidential Pardon

- Palmetto Solar Review: A Strong Choice for Going S...

- Verizon Fios Internet Review in Denton, Texas

- Verizon Fios Internet Review in Midland, Texas

- Best Cheap Phones for 2022: iPhone, Galaxy, Pixel ...

- Verizon Fios Internet Review in Surprise, Arizona

- Verizon Fios Internet Review in Lafayette, Louisiana

- Verizon Fios Internet Review in Simi Valley, Calif...

- Verizon Fios Internet Review in Kent, Washington

- Verizon Fios Internet Review in Concord, California

- 3-Motor Lucid Air Sapphire Super-Sports EV Debuts ...

- Samsung OLED TV First Look: Why It Will Probably B...

- Samsung's Galaxy Buds 2 Pro Feature Audio Perks, b...

- Verizon Fios Internet Review in Hartford, Connecticut

- Verizon Fios Internet Review in Coral Springs, Flo...

- Verizon Fios Internet Review in Stamford, Connecticut

- Verizon Fios Internet Review in Carrollton, Texas

- Xiaomi overtakes Apple as the world's No. 2 smartp...

- Verizon Fios Internet Review in Roseville, California

- Verizon Fios Internet Review in Gainesville, Florida

- New Electric Car Tax Credits Are About to Radicall...

- Snapchat's first diversity report shows a lack of ...

- Xbox Games Arrive On Samsung TVs in Cloud Gaming Push

- Samsung Galaxy Watch 5: All the Fresh Features, In...

- 'Prey' Review: The Predator Movie You've Been Pray...

- Verizon Fios Internet Review in Thornton, Colorado

- Verizon Fios Internet Review in Elizabeth, New Jersey

- Verizon Fios Internet Review in Cedar Rapids, Iowa

- Verizon Fios Internet Review in Topeka, Kansas

- Verizon Fios Internet Review in Charleston, South ...

- Best Buy launches smartphone for elderly community

- Verizon Fios Internet Review in Visalia, California

- Verizon Fios Internet Review in Waco, Texas

- Verizon Fios Internet Review in Thousand Oaks, Cal...

- Verizon Fios Internet Review in Miramar, Florida

- Porsche Taycan Turbo S Beats Tesla Model S Plaid's...

- 43 Labor Day Tech Deals You Don't Want to Miss

- Foldables Are Still Looking for a Breakout Moment....

- Verizon Fios Internet Review in New Haven, Connect...

- Verizon Fios Internet Review in Olathe, Kansas

- AI Arrives for Serious Photo Editing, Not Just Sma...

- Verizon Fios Internet Review in Sterling Heights, ...

- Verizon Fios Internet Review in Columbia, South Ca...

- Verizon Fios Internet Review in McAllen, Texas

- Verizon Fios Internet Review in West Valley City, ...

- Verizon Fios Internet Review in Warren, Michigan

- Elon Musk Sells $7B in Tesla Stock Amid Twitter Ta...

- 5 tips every Snapchat user should know

- Revamp Your Entertainment Space and Save up to $62...

- Pixel 6A vs. Samsung Galaxy A53 vs. Nothing Phone:...

- OnePlus Nord N20 5G Review: A $300 Value Pick That...

- Verizon Fios Internet Review in Bellevue, Washington

- Verizon Fios Internet Review in Frisco, Texas

- Verizon Fios Internet Review in Hampton, Virginia

- Verizon Fios Internet Review in Killeen, Texas

- Smartphone Accessory Deal: This Two-Pack of USB-C ...

- Verizon Fios Internet Review in Fullerton, California

- Verizon Fios Internet Review in Orange, California

- Elon Musk Says Tesla's FSD Software Is Getting a P...

- Samsung QN90B Review: This QLED TV From the Future...

- Samsung TV Plus Gets a Revamp Across Galaxy Device...

- Verizon Fios Internet Review in Pasadena, California

- Verizon Fios Internet Review in Clarksville, Tenne...

- Verizon Fios Internet Review in Syracuse, New York

- Verizon Fios Internet Review in Savannah, Georgia

- Verizon Fios Internet Review in Mesquite, Texas

- Older people are increasingly likely to own a smar...

- Verizon Fios Internet Review in Dayton, Ohio

- Verizon Fios Internet Review in Paterson, New Jersey

- Verizon Fios Internet Review in Naperville, Illinois

- Verizon Fios Internet Review in Hollywood, Florida

- X Shore 1 Aims to Be the Tesla Model 3 of the Sea

- Twitter lets iOS users share tweets as stickers on...

- Samsung Q60B TV Review: Slim, Stylish and Surprisi...

- Samsung Reveals New Gaming Monitor: Odyssey OLED G...

- Insta360 Link Webcam Review: Terrific but Costly

- Verizon Fios Internet Review in Lakewood, Colorado

- Verizon Fios Internet Review in Torrance, California

- Samsung to bring Galaxy smartphone repair service ...

- Verizon Fios Internet Review in Bridgeport, Connec...

- Verizon Fios Internet Review in Sunnyvale, California

- Verizon Fios Internet Review in Escondido, California

- Verizon Fios Internet Review in Joliet, Illinois

- Verizon Fios Internet Review in McKinney, Texas

- Why Tesla Thinks It'll Build Self-Driving Cars Bef...

- Best Smart TV for 2022: Top Picks in Every Budget ...

- What's New for Samsung's Galaxy Z Flip 4: Cool Scr...

- Verizon Fios Internet Review in Kansas City, Kansas

- Verizon Fios Internet Review in Rockford, Illinois

- Verizon Fios Internet Review in Alexandria, Virginia

- Verizon Fios Internet Review in Cary, North Carolina

- Nothing Shares Photo of Translucent Phone 1 Ahead ...

- Verizon Fios Internet Review in Pomona, California

- Verizon Fios Internet Review in Fort Collins, Colo...

- How to enable Snapchat log-in verification

-

-